Assessing the 757's passenger potential

Recent news that 27-year old Boeing 757-200s will operate transpacific services with US start-up carrier Northern Pacific Airways has surprised many in the industry.

Next month marks the 40th anniversary of the first 757 prototype flight, and many argue that its longevity is due to the lack of a true replacement.

And while it is an older-technology aircraft, operators do benefit from low ownership costs.

The prototype completed its maiden flight on 19 February 1982, and was certified by the FAA in December that year.

US carrier Eastern Air Lines introduced the model first into commercial service in January 1983.

Over the duration of the programme, almost 1,050 aircraft were delivered to customers. The last delivery was in 2005.

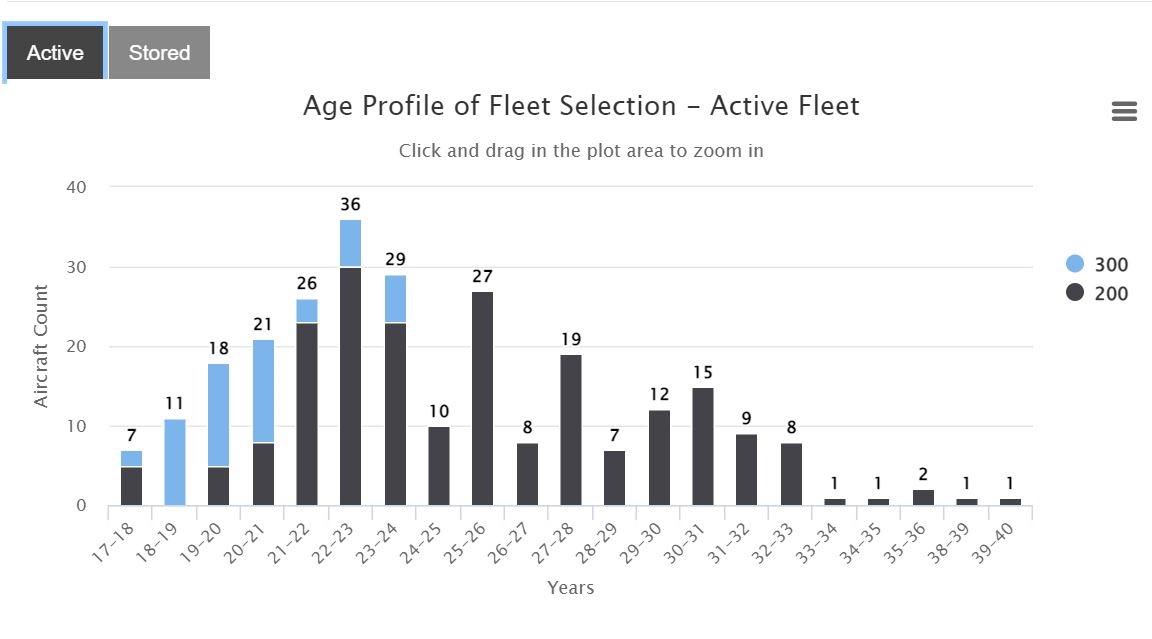

As of January 2022, a total of 739 Boeing 757 aircraft of all variants were still in commercial service with operators or in storage.

Delta Air Lines is the largest operator with 127 units. The top 10 operators for the type reflected the market evolution over the past 40 years: five customers are passenger airlines while the other five are freight carriers.

The passenger fleet accounts for 394 aircraft, or 53% of the current in-service and stored fleet.

Northern Pacific Airways, which could operate as many as six aircraft of the type, plans transpacific operations from Anchorage. It is waiting for government approval, but the start-up hopes it can commence operations in the second half of 2022.

“That is a surprise to see 757s serving transpacific destinations through Anchorage. Few passengers will want to stop in Anchorage,” comments Avitas senior-vice president - asset valuation Doug Kelly.

Airlines have been moving away from the type, even before the Covid-19 pandemic. Meanwhile the in-service freighter fleet continues to grow.

Airfinance Journal’s Fleet Tracker shows that the active 757 passenger fleet accounts for 269 units and many are still candidates for freighter conversion.

The increased appetite and slot availability of A321 freighter conversions will impact the 77 conversion programmes in the long term as operators may look at more efficient and younger converted assets.

“I suspect we will eventually see those 757s or younger vintages ending up in freighter conversions,” says Avitas head of valuations Douglas Kelly.

“There are still lots of 757 passenger aircraft in service, but most are past the prime conversion age of 20 years old or tied up with Delta and United.”

For Kelly the A321-200 is the best option to replace the 757 freighter as it is the closest in size and performance.

Oriel’s Olga Razzhivina agrees that freighter applications will continue to perform well in low-utilisation roles until the end of this decade.

“Passenger 757s are likely to be increasingly replaced by the new technology aircraft, especially as the price of fuel and environmental pressures mount. Any new deployments, like Northern Pacific Airways, are likely to be sparse and be short term until the operators can switch to younger aircraft at an acceptable price level.”

Collateral Verifications vice-president Gueric Dechavanne agrees. He says while there will still be opportunities for certain airlines to take advantage of the 757’s capabilities, it will become more difficult to ensure long-term support as the fleet continues to be retired.

“Those looking to operate the aircraft for passenger service will be competing with cargo operators for any spare parts and engines to support their fleet. This will most likely deter some potential new operators from looking at the type very closely,” he comments.