Analysis: Leasing Top 50 - 2016

Global operating lessors continue to bask in the sun thanks to a favourable environment of low interest rates, attractive funding, strong air travel demand and a continuing improvement in airlines financial results.

No doubt lessors’ business plans have continued to flourish as market fears of a new aircraft surplus, in the face of falling oil prices, have largely been exaggerated.

The market, to date, has not seen a systematic cancellation of aircraft simply because of the change in fuel prices, nor should it expect one anytime soon.

While the market is right to fret about the possibility of supply exceeding demand in the single-aisle aircraft market, market observers anticipate this won’t happen anytime soon.

Clearly giving lift to operating lessors’ outlooks is Asia's strong appetite for air travel.

Asian operating lessors are increasingly gaining market share. This growth stems from Asian financiers and governments increasingly favouring the industry, due to the increased development of their own aviation sectors and the currency benefits that are allowed through US dollar cash flows.

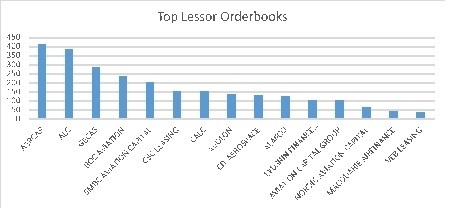

This year Ireland-based Avolon was acquired by Bohai Leasing, which is majority-owned by the Chinese conglomerate HNA Group. Chinese owned lessors in aggregate have a total of 1,124 aircraft, up from 645 last year. Rumours have it that a Chinese entity is the favoured bidder for CIT’s portfolio of 324 aircraft.

Other big gainers include Goshawk, up almost 100% to 69, Merx Aviation with 74 and DVB/Deucalion with 102.

Despite this growth, GECAS still retains the top spot with 1,450 units, and after selling $3 billion worth of aircraft in 2015.

It is also the most complete lessor in terms of assets: 36 turboprops, 344 regional aircraft, 166 widebodies and 904 narrowbodies. It will take a lot to knock the industrial giant from its top spot by an Asian competitor.

AerCap remains second with 1,166 units but again has the top spot by aircraft value at $31.9 billion. Overall, these two lessors have contracted by 271 units year-on-year, the study shows.

SMBC Aviation Capital moved to the third spot in this year’s operating lessors review.

Other lessors with significant increases in fleet size include Macquarie AirFinance to 207 units from 176 as they completed the purchase of around 90 aircraft from AWAS, Air Lease Corporation to 280 aircraft from 251, despite selling its ATR and E-Jet portfolios, and Elix Aviation Capital to 73 from 44 (all turboprops).

One firm that will probably not be in the top 10 next year is CIT Aerospace as its parent bank first indicated its intention to sell its leasing platform in November 2015.

The operating leasing industry keeps growing.

The study shows the top 50 lessors represent $260 billion-worth of assets, up from $234 billion in 2015.

Their revenues, and net income are also up on aggregate. The top 10 lessors had $18.6 billion combined revenues in 2015/16, up from $15.7 billion last year. Net income has gone up to $4.1 billion from $3.1 billion over the past 12 months. Return on equity remains in the eye-catching Libor plus 400-800 basis points range.

This sector remains a capital intensive industry but once again the study shows that lessor’s financial flexibility as measured by interest coverage (measured as ebitda/financing costs) are in a comfortable zone. The majority of them are at least two times, a healthy ratio.

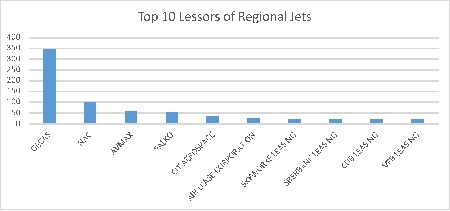

Less regionals

This year’s top 50 lessors ranking shows a fleet of approximately 8,675 aircraft under ownership and management. This compares with 8,185 units a year ago.

Top 10 lessors account for 5,200 aircraft or 60% of the Top 50 ranking. In last year’s ranking they represented almost two thirds with 5,330 units.

Overall, the largest lessors in terms of fleet size - Gecas, Aercap, SMBC Aviation Capital, BBAM and Nordic Aviation Capital (NAC) - have contracted by 200 units year on year, the study shows.

Aside NAC, a regional lessor specialist, their footprint in the regional jet and turboprop fleets over the past 12 months has diminished by more than 10%, confirming a trend to focus on the mainline sector.

As at August 2016, 455 regional jets and turboprops were owned and/or managed by the top 10 lessors, down from last year’s 510 total.

NAC has been the only entity increasing its exposure to the sub-120 seat regional market over the past year. It has further strengthened its leader position by acquiring a total of 50 aircraft from ALC: 25 ATR42/72s as well as 25 Embraer E-Jets. The Danish lessor also acquired two Embraer-focused operating lessors: Aldus Aviation and Jetscape, adding a further 69 E-Jets to its fleet. In June, NAC also purchased 19 E190s from Delta Air Lines, which is expected to close late in 2016.

Lessor’s exposure to the widebody market further reduced over the past 12 months to 15% from 15.3% a year ago. However their narrowbody market share is now at 69%, a 0.5 percentage point up from the 2015 figures.

As long as potential returns remain at or near current levels, it seems likely that the operating lease sector will continue to attract both new investors and the necessary capital to expand.

Michael Duff, managing director, The Airline Analyst contributed to this article.

To download The Leasing Top 50 2016 click here