Analysis: Where could Avilease invest next?

Avilease’s portfolio acquisition from Standard Chartered/Pembroke on 28 August propelled the Saudi Arabian-owned start-up into the top 25 lessors globally.

This transformative transaction means the lessor, backed by Saudi Arabia’s $620 billion Public Investment Fund, has 147 aircraft under ownership and 22 under management for a $6 billion balance sheet.

“This landmark transaction brings us one step closer to fulfilling our aim to be one of the top 10 global aircraft lessors by 2030,” commented Avilease chief executive officer Edward O’Byrne.

According to O’Byrne, Avilease is targeting a $20 billion balance sheet in seven years’ time with a 300 aircraft-plus fleet.

To achieve its goal, the Riyadh-based lessor is also targeting an investment grade (IG) ratings.

How will Avilease grow?

To date the Riyadh-based lessor has invested in narrowbody aircraft, but in an interview with Bloomberg, O’Byrne recognised that Avilease would need to balance its portfolio with widebodies going forward.

“We have one widebody aircraft but we have capacity to invest in more widebodies,” he said.

He recalls that the global commercial fleet typically includes a third of widebodies in terms of volume. “By 2030, we will have a balance sheet similar to the global fleet,” he commented.

Top 10 lessors’ exposure to the widebody market is normally 15-20% of their portfolio in dollar terms.

Therefore in seven year’s time, the Avilease exposure to that market could be around $3-4 billion worth.

With widebody assets identified as the next logical step, Avilease could acquire used or new units on a purchase and leaseback basis or in the secondary trade market.

But O’Byrne does not rule out purchases via the mergers and acquisitions market, mirroring the Standard Chartered/Pembroke Group portfolio acquisition.

Another route would probably be an order with the OEMs. Airbus and Boeing have been hit by supply chain issues as well as delays on some programmes, but on the widebody side the delivery skyline is clearer.

According to Airfinance Journal’s Fleet Tracker, there are 1,712 widebody aircraft on order of with approximately two-thirds being Boeing models.

In January 2023 O’Byrne said Avilease could place an aircraft order directly from manufacturers. He told delegates at the Airfinance Journal Dublin 2023 conference that first deliveries would be around 2028, adding that there is a clear undersupply in the market.

“When you place an order you have to watch who you compete with. OEMs as they have slots, average aggregate number for aircraft they produce, but also how many lessors have orderbooks.

“Certainly we are considering ordering aircraft, but under some circumstances,” he commented.

New technology assets will be a priority for the lessor and therefore the prime targets are likely to be the Airbus A330neo and A350 models along with Boeing 787s and 777X models.

According to Airfinance Journal’s Fleet Tracker, lessors own and manage 1,897 widebody aircraft.

Beyond the A350-900 and 787-9/10 investments, the A330-900 model is one to monitor.

There are 79 aircraft of the type owned and managed by leasing entities - more than three-quarters of the total fleet. Air Lease and Avolon are the main lessors in this market with a combined 74 firm orders, as of 31 July 2023, and 40 deliveries. The A330-900 has recorded eight sales since the start of the year but Avolon’s commitment at the 2023 Paris air show for an incremental 20 A330-900s for delivery between 2026 and 2028 has not gone unnoticed.

One leasing chief executive officer tells Airfinance Journal that his firm is looking at the model.

“Avolon clearly sees a market for that aircraft model in the future by committing to more units, in addition to the Malaysia Airlines transaction in 2022,” he comments.

As evidenced in the Standard Chartered/Pembroke Group narrowbody portfolio, the lessor could also acquire used widebody assets with long-term cash flows.

Saudi Arabia's PIF launched the aircraft lessor in June 2022, as part of its Vision 2030 economic transformation plan to diversify its economy away from oil, in part, by becoming a global transport hub.

The Riyadh-based lessor will grow through sale and leaseback deals, as well as secondary portfolio purchases and direct orders.

Since its launch it has originated purchase and leaseback deals in the primary market with Flynas (12 Airbus A320neo aircraft), and Saudia Group – parent company of Saudia and Flyadeal (20 A320neos).

The lessor also sourced 13 new technology aircraft in the secondary trading market, with leases attached from operating lessor Avolon. That portfolio included some widebody exposure.

When those transactions novate, the lessor’s portfolio will reach 45 aircraft.

So what does the Standard Chartered/Pembroke Group portfolio acquisition bring, beyond volume?

It boosts the lessor’s presence outside Saudi Arabia and brings new relationships for Avilease, especially in Asia, Europe and North America.

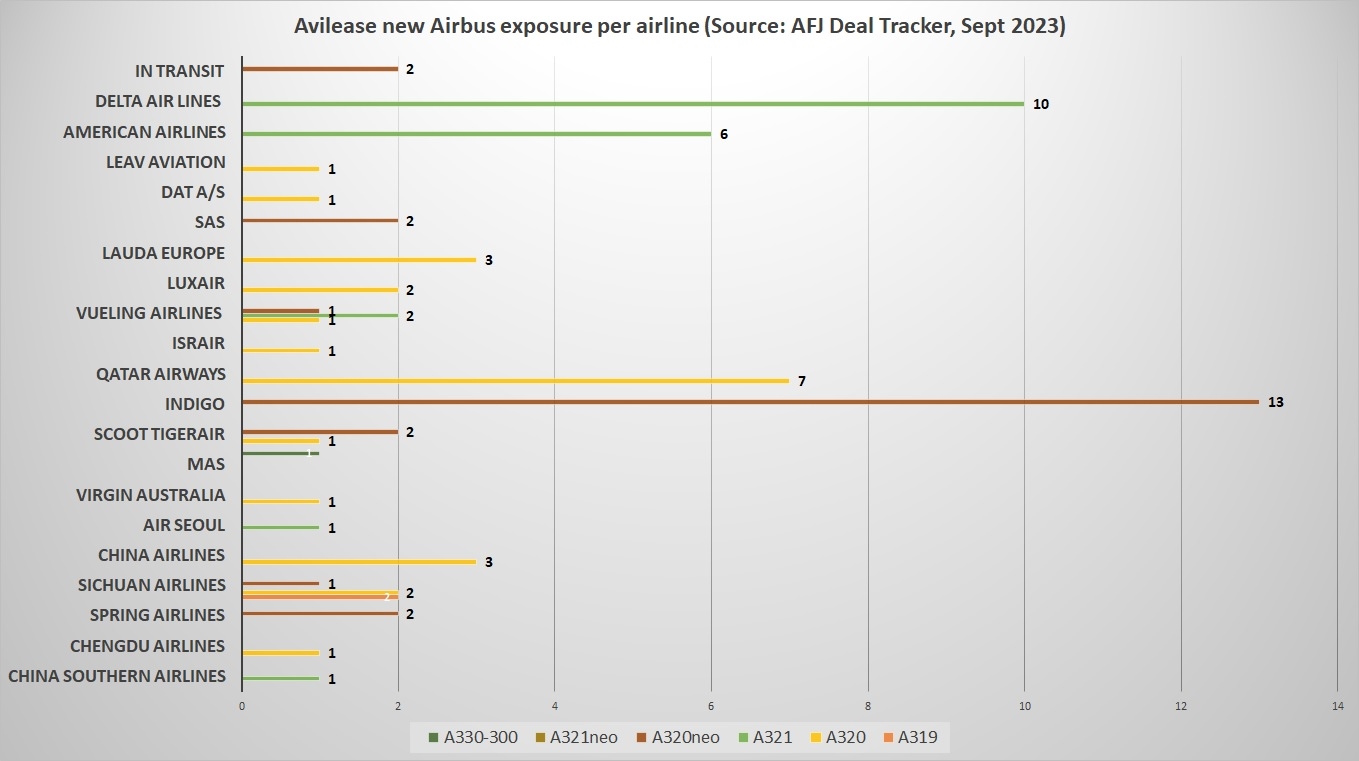

By the time the aircraft are novated, the USA will account for 26 aircraft with three large lessees: American Airlines, Delta Air Lines and Southwest Airlines.

Seven lessees in China will be added to the portfolio with a total 16 aircraft, including seven 737-800s and nine A320 family aircraft.

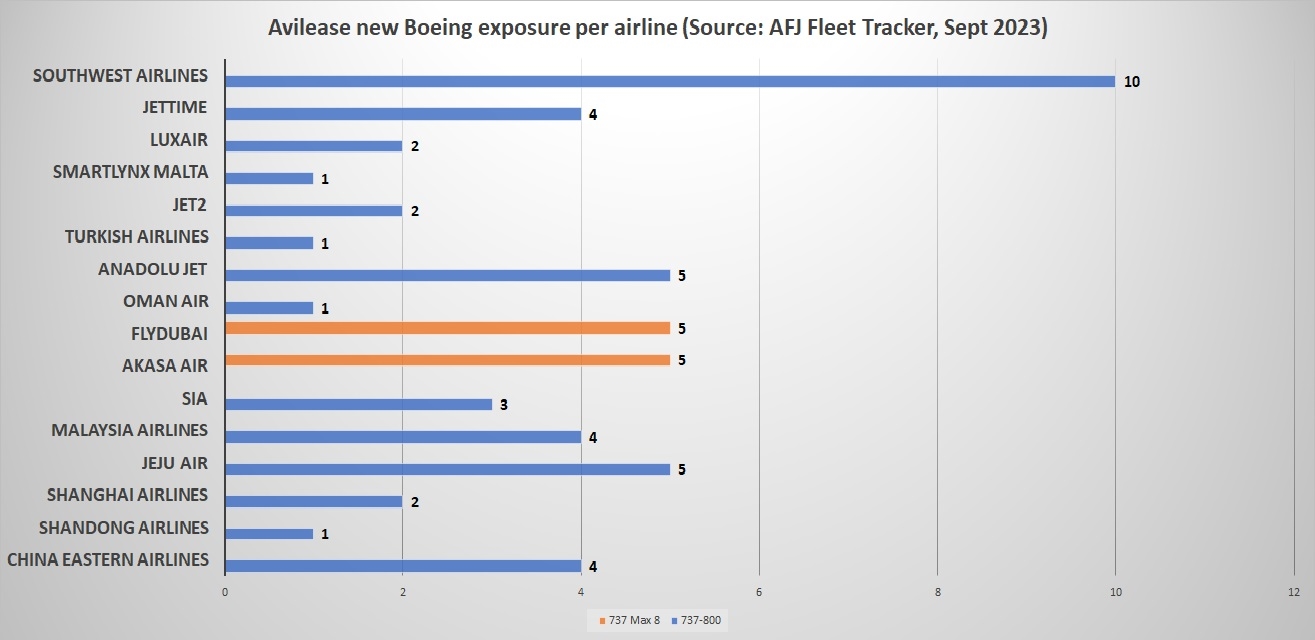

Airfinance Journal Fleet Tracker data shows new technology aircraft account for 32 units, or approximately 25% of the Standard Chartered/Pembroke portfolio acquisition.

There are 10 Boeing 737 Max 8 on lease to two customers: Akasa Air and Flydubai.

Indian exposure is also through Indigo Airlines with 12 A320neos. Other A320neo-family models are on lease to Spring Airlines, Sichuan Airlines, SAS, Scoot Tigerair and Vueling Airlines.

Other lessees include Jeju Air, Air Seoul, Virgin Australia, Malaysia Airlines, Scoot Tigerair and Singapore Airlines in the Asia-Pacific.

In the Middle East, where Avilease has primarily supported local airlines to date, Qatar Airways, Flydubai, Israir and Oman Air will be added to the portfolio.

The lessor is also adding 12 lessees in Europe with SAS, Danish Air Transport, Jettime, Leav Aviation, Jet 2, Vueling Airlines, Turkish Airlines, Anadolu Jet, Smartlynx Malta, Wizz Air Malta, Luxair and Lauda Europe.

No doubt it will next look at adding top carriers in this region.