Exclusive: The Slattery exit interview

Lord of the Wings - The trilogy ends. Slattery has called time on a career that has helped change the face of aircraft leasing. Laura Mueller finds out what motivated the man who climbed his “Everest”, his hopes for the industry and how his departure is impacting Avolon

Avolon confirms that Dómhnal Slattery is stepping down as chief executive officer (CEO), a role he has held since he launched the Dublin-based lessor with a small group of founding executives 12 years ago.

He is also retiring from aviation leasing after first entering the sector in 1989 with Guinness Peat Aviation.

Slattery will be replaced immediately by fellow founding member Andy Cronin, who has been the chief financial officer until now and president since 2021.

Paul Geaney, another founding member, becomes president and chief commercial officer.

Airfinance Journal first reported in April that Slattery would retire this summer and be succeeded by Cronin.

Avolon's other founders, John Higgins and Tom Ashe, retired in October 2021.

The move comes as a surprise to many, but Slattery insists his departure was planned before the Covid pandemic.

"We don't think for a second that I'm exiting early. To put it in the context of being the CEO for the past 12 years, and the two years prior to working on getting Avolon launched, it has been a 14-year journey," says Slattery. "The energy, the passion that's required, it is all-consuming and now is the right time to pass that baton."

In 2019 the founding group of partners sat down in the fourth quarter as Avolon approached its 10th birthday. Avolon was at the "peak of its strategic relevance" and looking forward to a robust financial performance in 2020, he recalls. At that meeting, the group decided that "now is the moment" for the older part of the group to begin to hand the reins over to the younger generation.

"What drove that process was a belief that leadership in an organisation has finite relevance. One of the lessons we learned along the way was sometimes leaders stay in situ for too long, and they lose the edge, the relevance, the energy that leads to passion. We refer to it as the death rattle.

"And so culturally, it was clear to us, that we needed to pass the baton over once we were still in our 'A' game. The plan originally was that this was all to happen in 2020, but we put that on hold, given the Covid backdrop. John and Tom exited last year, and I'm exiting now."

Despite Avolon's Chinese owner, Slattery denies that his departure or the management shuffle has anything to do with the upcoming Communist Party National Congress in late 2022 – an event tipped to spur changes across the Chinese leasing industry, including the sale of non-domestic exposure and other divestitures.

"Whatever political dynamic exists in China will have its own cadence and its own rhythm. I mean, the reality is, we've been dealing with a very dynamic situation with HNA going all the way back to 2016," he says.

"Avolon is 70% owned by Bohai, which is an independent leasing entity based in China. Its shareholding has changed dramatically as a consequence of the trust structure. Who knows what happens at the end of the year, but we gave up many, many years ago trying to plan any corporate activity around what may or may not happen in China."

Cronin also dismisses the suggestion. "Frankly, we run the business as a standalone, international business, and we do the right thing by the business. Our ownership is stable. And what many people don't know is that the airline group is now completely split away from the HNA Group.

"If you look at Bohai, it is trading multiples, it is actually on par with the US public lessors, so we continue to run our business as an internationally owned, standalone, independently funded business. And, frankly, the shareholder composition may change from time to time. We've been through probably four or five different iterations of that at Avolon in the first 12 years."

When Avolon introduced Orix as a 30% shareholder in a $2.2 billion deal in 2018, the primary reason was to insulate Avolon's balance sheet and its governance from the day-to-day events in China, adds Slattery.

Following months of deliberations, in 2019 Orix declined the opportunity to purchase the remaining 70% from HNA, Bohai's embattled parent, citing concerns that such a significant acquisition could negatively affect its credit ratings.

HNA Group was effectively seized in February 2020 by the provincial government of Hainan, the southern island province where it is based, after a rapid expansion that resulted in $310 billion of debt.

In October 2021, HNA reached an agreement with creditors on a debt-restructuring plan. It handed over control of its core airline operations to Liaoning Fangda Group Industrial, ending an era of ownership by the Chinese conglomerate.

HNA said its restructuring was completed in April.

History books

The making of Slattery as an entrepreneur follows the classic, formulaic plot structure of a hero’s journey; the conflict resolution arc of mettle forged through trials and tribulations, with leasing, though, being the constant that enabled personal and business transformations.

As a child, Slattery was intrigued by aviation, joining his father every Saturday to deliver vegetables to Shannon Airport. But at age 11 he lost his father and was forced to take on work to help support his family.

He paid his way through the National University of Ireland in Galway. After graduation, he joined Guinness Peat Aviation, the world's largest aircraft lessor at the time, founded by entrepreneur Tony Ryan.

But when GPA collapsed in 1992 after a failed initial public offering, Slattery left the firm. He set up his own company, the International Aviation Management Group, a boutique air finance consultancy. Tony Ryan took a 20% share and was later bought out by Slattery.

In 2001 Slattery sold the business for a reported $39 million to the Royal Bank of Scotland (RBS), which used it as a launch platform to start RBS Aviation Capital. He led the lessor through 9/11 and reduced risk across other existing aircraft leasing activities across the wider RBS group. By 2004, RBS Aviation was the third largest aircraft lessor.

With money in the bank, he changed gears in 2005 and set up the private equity firm Claret Capital as a family office to manage his wealth and invest in diverse sectors such as real estate and media. However by 2008, with the financial crisis in full swing, Claret Capital was in trouble.

"I was well on my way to becoming a billionaire, and suddenly I had lost everything. But I had a wife, four children and a mortgage to pay," Slattery told an INSEAD business paper in 2018. "I had 27 cards in 27 investments – in the end it was a di-worse-ification."

Using his past industriousness and credibility in aircraft leasing, he was able to persuade Oak Hill, CVC and Cinven to support his return to leasing with the launch of Avolon.

Oak Hill, Cinven and CVC contributed equally to a $750 million equity cheque that was buttressed by a $650 million revolving credit facility by UBS – the first of its kind for the aircraft leasing industry since the 2008 financial crisis.

Launched in 2010, the name Avolon is based on the island of Arthurian legend, Avalon, but with the "a" replaced with an "o" to incorporate the word "vol" – French for flight.

While King Arthur used the island for his wounds to heal, Avolon was set up to extricate Slattery from a private financial crisis following the success of his past endeavours in aviation.

The first deal included the purchase of six Airbus A320s from Aercap on lease to Alitalia, Frontier Airlines, Spring Airlines and Air Arabia. In addition, Avolon took a 50% interest in three A330s on lease to Aeroflot.

Going public

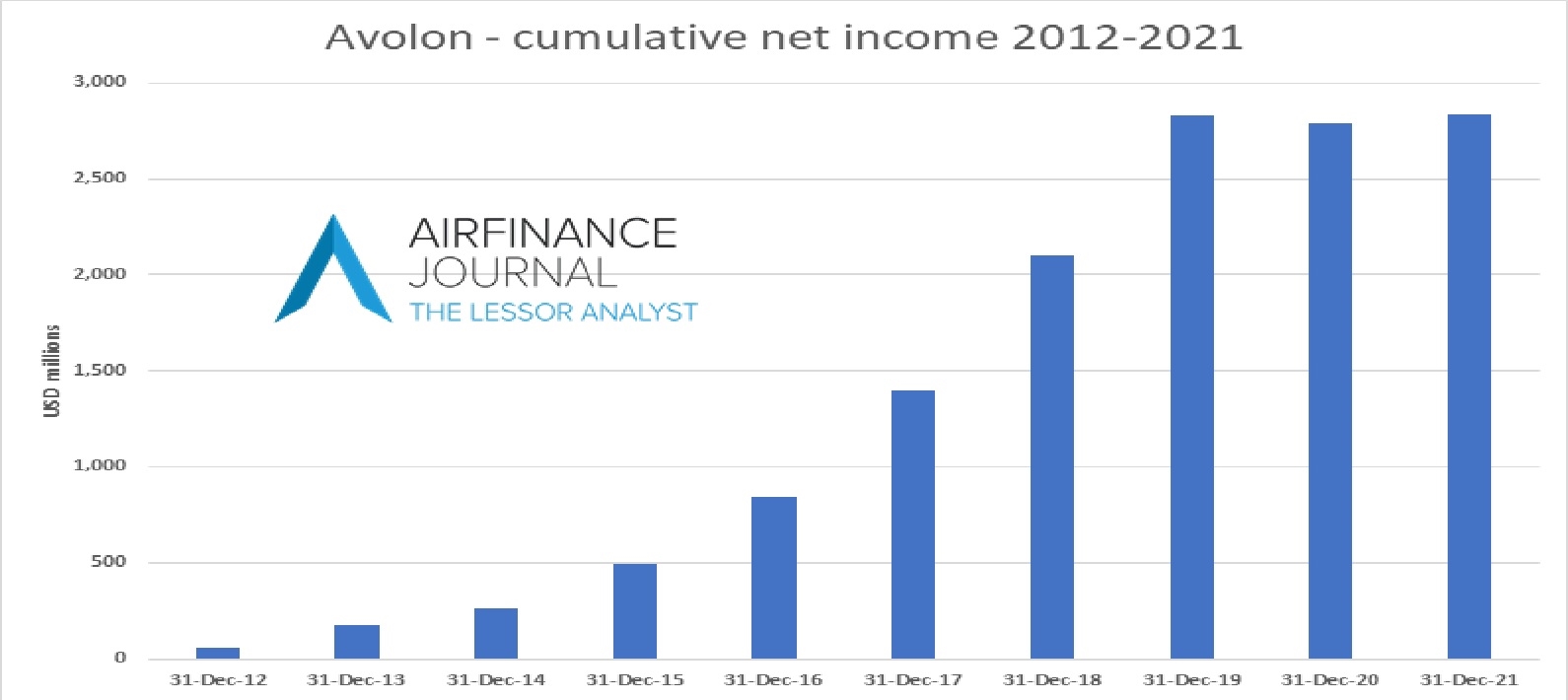

Under Slattery, Avolon went from a private equity start-up to a lessor with sustained profits that, on 14 December 2014, became the largest Irish company to list on the New York Stock Exchange. The IPO also marked the "single most resounding memory and proudest memory" for Slattery in his professional career.

"It was the summit of my own personal ambitions at that point in time, it was a wondrous, joyous thing to do. And without a doubt, that's the Everest," he says.

"If you start a company, and you ultimately can get it to a size, scale, and relevance, that you can take it public, and people want to buy your shares, I think as a businessperson, as an entrepreneur, that's the ultimate tip of the hat – that others are prepared to buy your stock.

"It's not easy to build a company, scale it and take it public. If you look at it in an Irish context, we are one of very, very few in any sector to have gone public in the last 10 years. And in the aircraft leasing sector, it's been a very small cohort. "

The reality on that day was that the stock finished below its IPO strike price.

"So it wasn't a great day, that particular day, but 8-10 months later, we sold the company for $31 a share, which today still is the biggest single annualised return, monetised ever for an aircraft leasing company in the public markets. So nobody can take that away from the Avolon history book."

On 8 January 2016, Avolon de-listed from the New York Stock Exchange after being acquired by the conglomerate through its subsidiary business, Bohai Leasing. At the same time, Avolon assumed control of Hong Kong Aviation Capital, a leasing platform owned by Bohai.

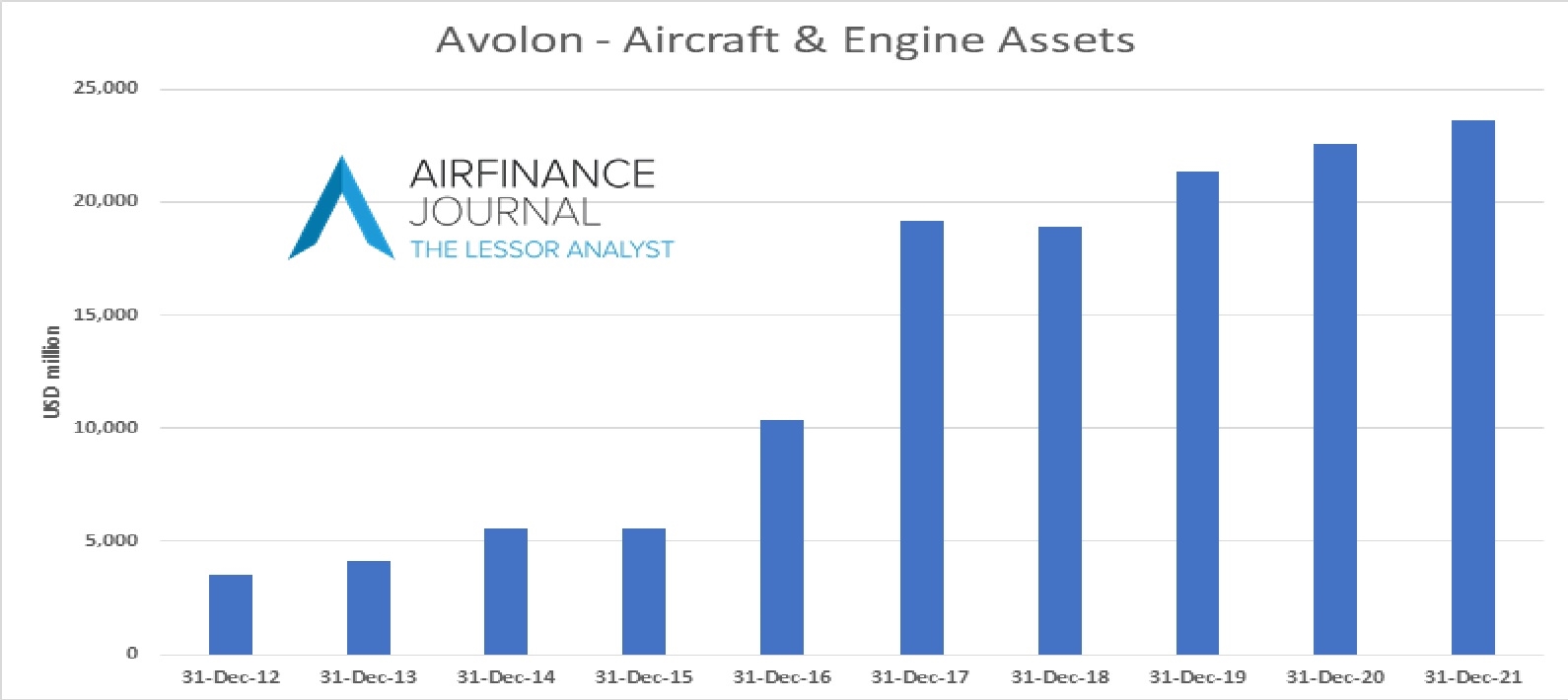

The deal marked Ireland's largest cross-border M&A deal. Avolon went on to purchase CIT Holding's aircraft leasing business in 2017. Avolon is now the second largest aircraft lessor with a balance sheet in excess of $30 billion.

As a serial entrepreneur with four companies under his belt, and three in aviation leasing, Slattery claims the desire to make people's lives better drives him out of bed in the morning.

"I felt the relevance of the industry was changing people's lives. The development of low-cost carriers, globally, was changing people's lives for the positive and that an aircraft leasing company, like Avolon, could enable that economic activity globally, this is sort of the higher purpose," he says.

"That then evolved into what I believe is the right higher purpose for many decades to come, and that's being the thought leader in the decarbonisation of our industry."

In June 2021, he declared ambitions to pave the path to electrification by investing in the electric vertical take-off and landing (eVTOL) market with a $2 billion order for up to 500 eVTOL aircraft from UK-based Vertical Aerospace.

Perhaps predictably, he insists it has not only been the business but the "fun" that has kept him in the industry. "Some of the characters, the friendships that I've built all over the world, whether it's at the OEMs, but more particularly the airlines, they are great entrepreneurs, great risk takers against all the odds. That's just been a thrill and a privilege.

"Of course, I'm also highly motivated by creativity, building things and scaling businesses. At the end of the day. I'm an entrepreneur - it is kind of what I do."

Cronin describes Slattery's legacy as a multi-headed hydra. "It has inspired a lot of singing, dancing around, good times, fun, joie de vivre and energy. That will live on and on for sure," he says.

He points to an engagement survey earlier this year that took place three months after staff were called back into the office on a full-time basis.

"And there was one statistic which jumped out, which was that 93% of people would say that they were proud to work for Avolon. I think that's a statistic to be incredibly proud of."

Slattery hopes the legacy that endures is twofold. "In the decades from now, it is that the cultural foundation stones are just as strong then as they are now and perhaps better."

This is based on the lessor's culture captured in the acronym TRIBE: transparency, respect, insight, bravery and ebullience.

"We thought long and hard about those values when we put them together 12 years ago, about the behaviours that travelled with those values. We've worked hard to help those values flourish," he says.

"Sometimes we succeed, sometimes we don't, but they're the guiding principles of the firm in terms of how we make business decisions, recruitment decisions, exit decisions and deals."

Second comes team development. "That we were able to develop a team of people, a bench, such as the US leadership parlance, at Avolon with Andy and Paul being the tip of that spear, who were bred effectively to succeed and take on the ambition, the challenge and division of the firm," he says. "The fact that we were able to have a bench that was ready and better, frankly, than the incumbent.

"Those are my two legacy pieces."

During the same week as the Farnborough air show, Slattery's last at the helm, the UK recorded its highest temperature since records began, the European Central Bank ended an eight-year run of negative interest rates, the Ukraine conflict entered its 21st week, global supply chain problems continued, and business confidence slumped as Europe's largest economy teetered on the brink of recession.

Yet leasing is used to global challenges. "The aircraft leasing industry is uniquely positioned, and it's exposed in many ways to a lot of the good things that happen in the world and a lot of the bad things directly or indirectly," says Slattery.

"Over the last 30 years, any quarter, there's been challenges, whether it's interest rates, whether it's oil, whether it's geopolitics. Each cycle, each year, there is always something. At Avolon, we've always felt that the differentiator between management teams, or those with the experience set that we have and the others, is that we're adaptable, nimble, and frankly, forward-thinking enough to be able to make sure that we can navigate what is a neverending series of challenges."

Start-up lessors will face problems, he thinks. "There's very little operational expertise in any one of those entities. And it's going to be a real challenge for them to exist and scale in a market that's quite challenging. And that's why, frankly, I am delighted when I am stepping off now that I'm handing the baton to somebody with the strategic dexterity that Andy Cronin has because he's been at this game for 20 years."

In other words, operating leasing has become a highly commoditised industry, where scale and experience drive cost advantage. So, are outsized returns on capital a relic of the past?

"I think there's a lot of truth in that. What also travels with that, though, is the risk inherent in the industry is also significantly reduced. The amplitude of the volatility is infinitely less than it was 10 or 15 years ago, the quality of the investment grade lessor is the fact that you have a duopoly, and the risk quotient for the industry has come down. Therefore, the returns have come down because it attracts more capital.

"And also, for the investment grade lessor issuers, the cost of capital has come down dramatically. Now it has blown out in the last couple of months, as it has with pretty much everything, but this industry is in the process of commoditising. There's no question about that. There'll be a smaller number of bigger players, i.e. more consolidation."

For him, the days of the "supercharged equity returns" are long gone. Instead, the industry will begin to attract "more infrastructure-type returns," that are relatively safe and stable. Still, predictable cash flows have allowed the capital markets to "really embrace" aircraft leasing in the last decade, he adds.

Slattery previously indicated at Airfinance Journal's Dublin event in May that Boeing must "fundamentally re-imagine its strategic relevance in the marketplace" and might need new leadership to fix a company culture that had become "totally warped".

Asked how he viewed the performance of Boeing's management nearly three months later, Slattery says: "Look, these guys are dealing with a very tough set of factors. Whether it's product engineering or geopolitics, it's just not easy. And sometimes, it is easy for me to take a sideswipe at them.

"I have a lot of respect for these guys, their jobs are complex, and it's not easy. But ultimately, they've got to deliver for their shareholders. And I think in the last couple of weeks, we're starting to see some green shoots, with talks of 787s getting delivered, some orders for the 737 Max. Okay, there are 737-10 certification challenges still there; maybe they'll get over that, and maybe they won't."

Has there been a cultural change from his vantage point?

"Well, they're moving their head engineer back to Seattle, and the optics of that are very powerful. Then the key will be the impact that has on the actual operating workflow of the business," he says. "The reality is, while they're trying to reinvent themselves, they've got a lot to focus on, such as what their next new airplane plan will be and whether it's the NMA or something of that ilk, or whether it is hydrogen-powered, so there is a lot."

Going vertical

Slattery told Airfinance Journal in an earlier interview that achieving net zero was "the single biggest and most audacious goal" for the industry, unquestionably.

Avolon-e, which is partly owned by Avolon and a small number of its executives, including Slattery and Cronin, launched in June 2021 to make purchases in the eVTOL market as part of the net zero agenda.

The lessor is among the launch customers for up to 1,000 eVTOLs being developed by Vertical Aerospace.

With partners including Rolls-Royce, Honeywell and Microsoft, along with GKN, Leonardo and Solvay, Vertical is now in the later build stages of the VX4, with its full test flight programme to commence later in 2022.

Slattery says Avolon-e will continue as a jointly owned entity and "see where that goes."

At the Farnborough air show, Vertical Aerospace confirmed 50 VX4 delivery slots and the commitment of associated pre-delivery payments with American Airlines.

The commitment to pay pre-delivery payments and confirmation of slot reservations for the first 50 aircraft is believed to be the first of its kind for a major airline in the eVTOL industry.

"As I hand the baton to Andy, the thing that I'm most excited about is my chairmanship at Vertical and what we're trying to do there. I'm excited because it's important work, but it's also very complex work; trying to build and certify a novel aircraft isn't easy," he says. "But if we crack it, we could change the world."

(Additional research from INSEAD business report)