Should Jolco investors be concerned about SAS?

Japanese capital providers are closely monitoring developments at Scandinavian Airlines (SAS) over the next few weeks as the group continues its restructuring process.

SAS recently drew down on its SEK3 billion ($363 million) credit facility which is 90% secured with its main owners, the Danish and Swedish governments, which hold 21.8% each of the airline.

Last week, one of the two government owners, Sweden, signalled its intention to stop injecting fresh capital into the group. Sweden plans to convert debt to equity as a "responsible" shareholder, though.

However Denmark is willing to write off debt owed by SAS and inject more capital, according to its finance minister, Nicolai Wammen. The Danish state could end up with ownership of somewhere between 22% and 30%.

The governments' positions may cause uncertainty for Japanese investors.

SAS Group’s 127-aircraft fleet, according to Airfinance Journal’s Fleet Tracker, is mainly under operating leases and finance leases.

The regional fleet comprises 15 Bombardier-MHI CRJ900s, along with three ATR72-600s and one Embraer 195. The widebody fleet includes six Airbus A350-900s and eight A330-300s. The narrowbodies include four A319s, nine A320s, eight A321s, 50 A320neos, three A321neo, 13 737-700s and seven 737-800s.

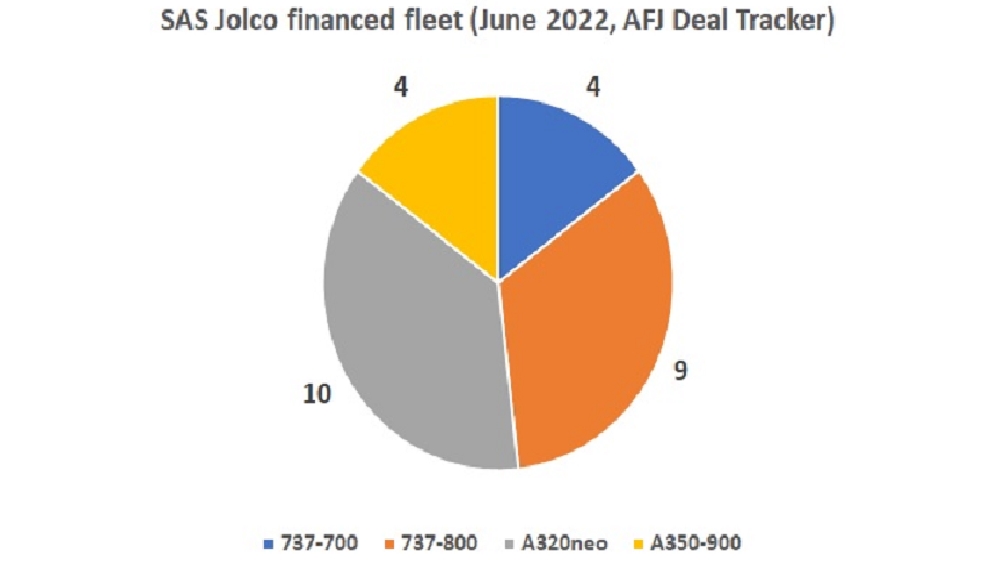

Airfinance Journal’s Deal Tracker shows that SAS has closed five multi-aircraft financing transactions through the Jolco market since 2020.

It financed a total of 10 new Airbus A320neo aircraft in 2020 with a syndicate of European banks, Sumitomo Mitsui Banking, Bank of China and National Bank of Australia on the debt side. Financial Products Group and JA Mitsui Leasing acted as equity underwriters.

Since then it has closed transactions to finance several A350-900 assets with some of the banks that participated in previous transactions.

Last December SAS refinanced an A350-900 aircraft under an insurance-supported Jolco, the first transaction of the type. Credit Agricole-CIB acted as overall Jolco equity and debt arranger. The insurers were SOMPO Japan Insurance and Aioi Nissay Dowa Insurance, with international reinsurance support from Axis Insurance and Fidelis Insurance. Piiq Risk Partners structured the transaction through its Integrated Finance Linked Insurance (IFLI) product.

Deal Tracker shows that SAS also refinanced nine Boeing 737-800s and four 737-700s between 2016 and 2018 through the Jolco market.

One source tells Airfinance Journal that Jolco-financed assets are not part of the restructuring.

“SAS will avoid the Jolco structures for the time being, to protect them from a potential default scenario and maintain its reputation as reliable Jolco lessee. It also wants to preserve its future for other opportunities in such market,” the source comments.

Restructuring

SAS, which reported a SEK1.52 billion net loss in the second quarter, is embarking on a new restructuring plan to adapt to the Covid-19 pandemic, allowing it to deleverage its balance sheet while substantially improving its liquidity position.

The restructuring programme targets a SEK7.5 billion annual cost reduction, the bulk of which will be implemented over the next five years, including SEK3.5 billion of new savings on top of savings announced in 2020 in response to the outbreak of the pandemic.

In addition to reducing its cost structure SAS is seeking to convert approximately SEK20 billion of existing debt and hybrid notes into common equity of which a majority is on-balance sheet debt and hybrid instruments. The contemplated conversions are designed to strengthen the balance sheet and significantly reduce the debt burden.

In addition to debt conversions, SAS is looking for alternatives to raise new equity. It says it will seek to raise not less than SEK9.5 billion in equity capital and anticipates that a significant share of such new equity will likely be sought from new investors.

The Danish government move may have provided some relief after speculation about a potential Chapter 11 filing.

Earlier this month sources told Airfinance Journal that SAS could file for Chapter 11 bankruptcy before the end of the summer.

According to a memo document seen by Airfinance Journal, the European carrier has been exploring a potential United States Chapter 11 bankruptcy filing and could have filed within two to three months.

“This time-frame is supported by SAS’ current cash position of over 8 billion krona – which is close to $1 billion,” the document said.

SAS has retained Seabury as its fleet adviser and investment banker, Weil Gotshal as its primary bankruptcy advisers, and FTI as its financial adviser.

The weeks ahead will be crucial.

“Given SAS’s fairly complicated and multi-national capital structure, the conventional wisdom is that the flexibility of the United States bankruptcy processes, and the familiarity with DIP financiers in the protections that can be provided under a U.S. Chapter 11 bankruptcy, makes a United States filing more attractive to SAS than an English or Irish law administration proceedings,” the document said.

“SAS will undoubtedly possess sufficient jurisdictional nexus to file in the United States as any entity that has a place of business or property - literally any assets – including any bank account - in the United States can commence a United States bankruptcy case,” the document added.

According to the document, SAS is seeking debtor-in-possession and exit financing of about $550 million and remains interested in sourcing several hundred million dollars of additional financing for the procurement of additional narrowbody aircraft.

“Jolco providers will be wary of the situation even if they are not directly exposed,” said a banking source.

“The fact that type of financing is not on the agenda is, from what I understand, a form of pious hope for the exposed banks,” comments another source.

“It is true a restructuring of Jolco may be more difficult, cumbersome and complex … but at the end of the day the borrower decides as part of his restructuring which pockets of debt to target,” the source adds.

When contacted SAS said it does not comment on speculation.