Analysis: Asian carriers face stark load factor challenge

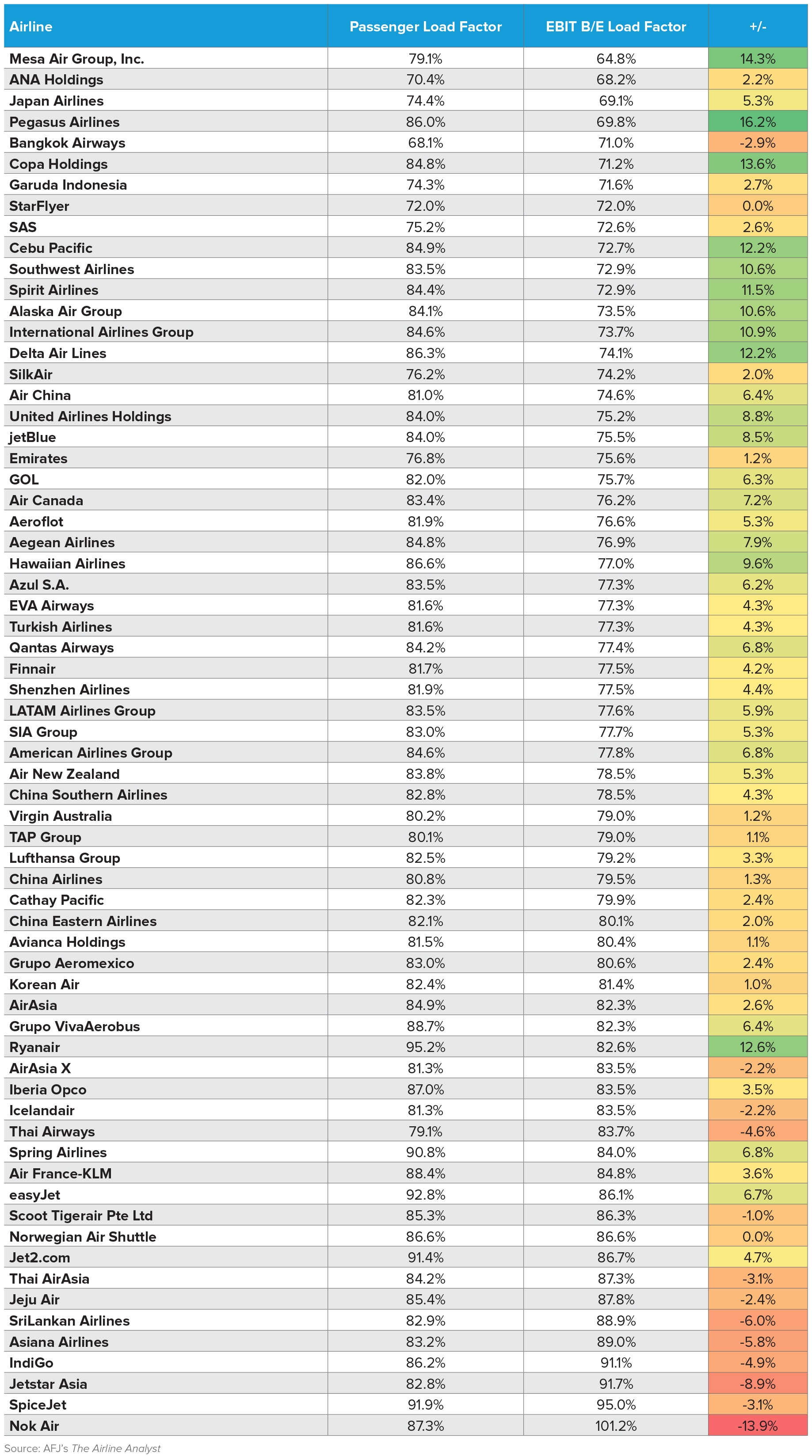

Of more than 60 global airlines surveyed by Airfinance Journal’s The Airline Analyst, approximately a quarter have reported average seat load factors insufficient to break even when assessed against reported earnings before interest and taxes (EBIT).

The airlines that have managed to achieve that over the past 12 months include many US carriers, led by Mesa, Delta, Spirit, Southwest and Alaska, as well as Ireland’s Ryanair, which all recorded passenger load factors more than 10% greater than required to break even on an EBIT level.

In Latin America, Copa performs well. The Panama-based carrier sold 84.8% of its capacity over the past financial year, which was 13.6% more than would have been required to meet its net income requirements.

Asian carriers, especially budget operators, find themselves at the bottom of the list. Thai budget carrier Nok Air fares by far the worst. The Don Mueang-based carrier would have had to sell more seats than it has in order to turn a profit, and that was before Covid-19 struck.

Its local competitors are not doing much better: Thai Airways showed a 4.6-percentage-point deficit from its break-even load factor, Thai Airasia was 3.1 points short and Bangkok Airways’ data highlighted a 2.9-point deficit.

Jetstar Asia, Srilankan Airlines, Asiana and Indigo also had shortfalls over the past 12 months. Respectively, they were 8.9, 6, 5.8 and 4.9 percentage points below the load factor needed to record a positive EBIT.

Other carriers in the red on a load factor basis – although markedly less so – included Spicejet, Jeju Air, Scoot, Airasia X and Icelandair.

Under-administration Avianca and Virgin Australia did pass our load factor-EBIT stress test over the past 12 months, suggesting that other factors including overheads and financing costs contributed to their struggles.

While many governments want passenger flights to resume as quickly as possible, some have also called for an empty middle seat to facilitate social distancing.

If that were to become the new normal, at least until a Covid-19 vaccine became readily available, then one would have to assume a maximum passenger load factor of 67%.

Applying this to our dataset, only US regional carrier Mesa would still generate positive EBIT if an empty middle seat became mandatory, assuming all other variables were unchanged. All other airlines would need to raise fares and/or reduce costs to do so.

This is one of the many reasons why the International Air Transport Association (IATA) is staunchly opposing the empty middle seat, as it would effectively kill many airlines already severely distressed pre-Corona.

Geneva-based IATA argues that on-board social distancing is obviated by the wearing of face masks as well as the transmission-reducing characteristics of the cabin, which include the facts that everybody is front facing; air flow is from ceiling to floor; seats provide a barrier to transmission; and air filtration systems operate to hospital standards.

IATA forecasts that the Covid-19 crisis will see global airline passenger revenues drop by $314 billion in 2020, a 55% decline compared with 2019. Airlines in Asia-Pacific will see the largest revenue drop - $113 billion - in 2020 compared with 2019 (revised from an $88 billion drop in IATA’s 24 March estimate) and a 50% year-on-year fall in passenger demand (-37% in 24 March forecast).

These estimates are based on a scenario of severe travel restrictions lasting for three months, with a gradual lifting of restrictions in domestic markets, followed by regional and intercontinental routes, and as such they remain highly likely to change.

IATA is calling for a combination of direct financial support, loans, loan guarantees and support for the corporate bond market, and tax relief.

“The situation is deteriorating. Airlines are in survival mode. They face a liquidity crisis with a $61 billion cash burn in the second quarter. We have seen the first airline casualty in the region. There will be more casualties if governments do not step in urgently to ensure airlines have sufficient cash flow to tide them over this period,” said IATA's regional VP for Asia-Pacific, Conrad Clifford.