Analysis: CALS chairman caught up in China’s P2P clampdown

Jiedong Min was detained by the Shanghai Public Security Bureau’s (PSB) Changning District branch on 16 July.

Min is chairman of CALS Financial Leasing (Shanghai), China International Aviation Leasing Service and Shanghai CALS Aviation Equity Investment Fund Management, according to calsaviation.com.

The Shanghai PSB announced an investigation into a company he owns called Xindacang Group, which owns a stake in CALS Financial Leasing (Shanghai). The investigation relates to peer-to-peer (P2P) fundraising.

The Shanghai PSB says Min and other unnamed suspects made a commitment to return investors’ invested capital, along with profit, over a fixed investment term, but then gathered large amounts of money from the public illegally. Min and the suspects established at least three companies: Haoyoubang Everwin Financial Information Services (Shanghai), CALS Financial Leasing (Shanghai), and Shanghai Haoyin International Trade. Min and the suspects set up retail outlets around China and an online platform for Haoyoubang, using the terms “物权众筹” (property crowdfunding) and “融资租赁” (financial leasing).

The Shanghai PSB, which is taking “criminal coercive measures” against Min, adds it is doing its best to investigate the case and is trying to recover investors’ losses. “Criminal detention” is among the five “criminal coercive measures” stipulated in the Criminal Procedure Law of the People’s Republic of China.

The Shanghai PSB is taking action against Min and the other suspects for the “crime of illegally absorbing of public savings” (非法吸收公共存款罪)”.

On 15 August, around one month after the Shanghai PSB annoucement, Airfinance Journal reported that Min had falsely claimed an honourary degree from Columbia University in New York City.

Justin Sun, a partner at Holman Fenwick Willan (HFW) who acts for several Chinese lessors, says the impact of Min’s detention on CALS will depend on the other shareholders of the company.

“Will that mean the shareholder will basically be seriously impacted? If that is the case, my own view is that it will be quite serious. Also, if crowdfunding starts to be more heavily scrutinised and regulated, this may have impact too.

“At this stage, it’s just difficult to find out what is exactly the real reason behind Min’s detention. Is it just an individual issue with the chairman? If so, probably the impact will be less profound.”

P2P fundraising for aircraft: a reality or fantasy?

It remains unclear whether any CALS-branded entities, Haoyoubang or CN Aviation Loan (Haoyoubang's internet finance platform) actually completed any P2P internet fundraising transactions for aircraft, or even whether they completed any conventional operating lease transactions.

Peter Huijbers, chief executive officer of CALS Aviation, a brand that covers Irish-registered China International Aviation Leasing Service and Hong Kong-registered Pacific Clipper Leasing, declines to disclose any fleet data or provide information about any deals the companies may have done. He also declines to say whether the crowdfunding P2P/funding model is something CALS will continue to pursue in future.

“CALS Aviation Group has never made public statements to this extent and continues to do so,” he says.

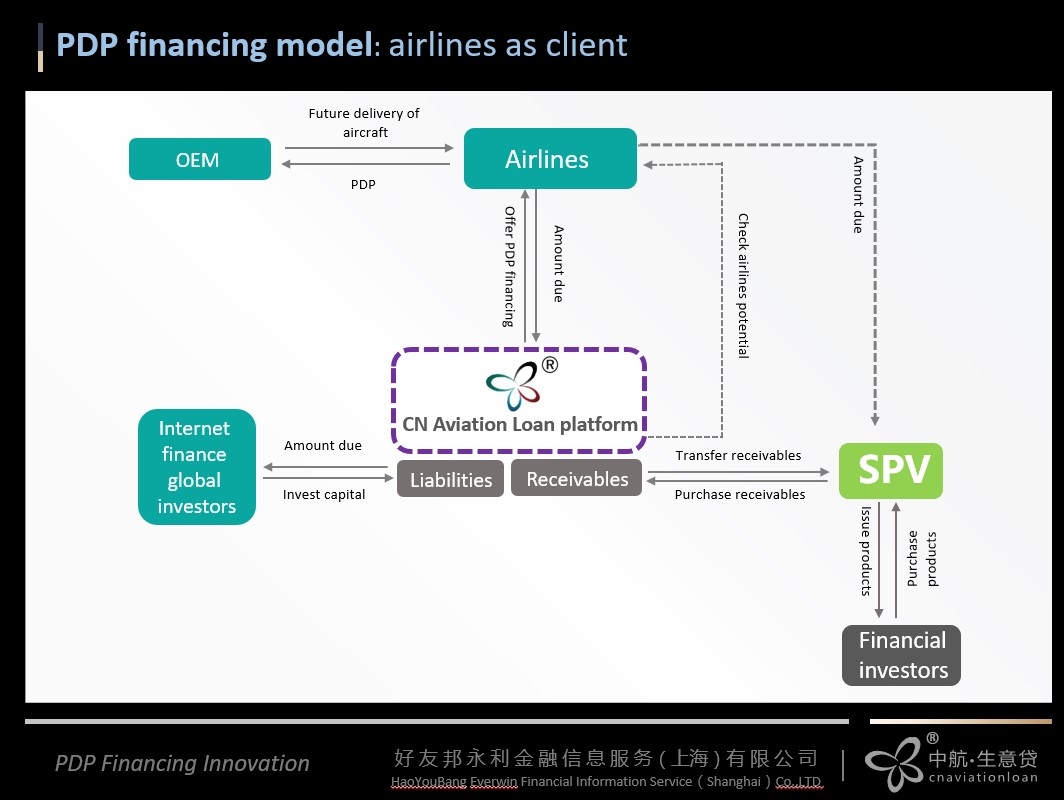

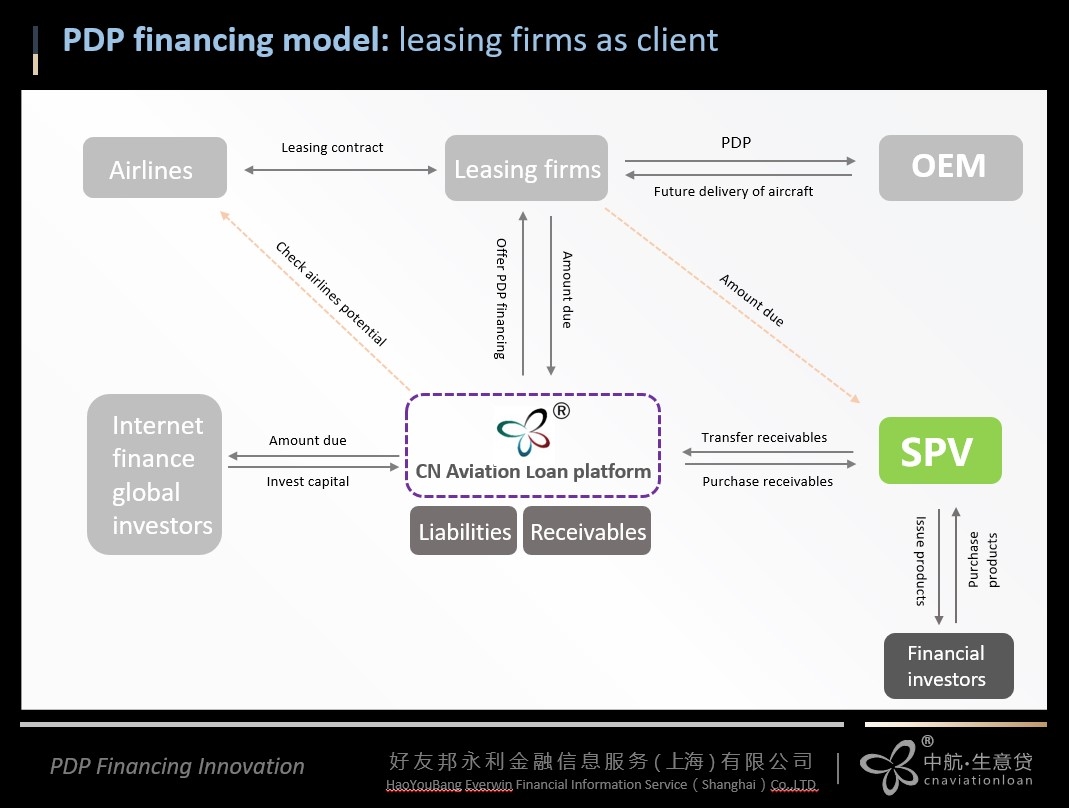

How Haoyoubang and CN Aviation Loan proposed to structure PDP-P2P internet financing for aircraft can be seen from a chart included in a company presentation sent to Airfinance Journal in June 2016 by Min and replicated in a different company presentation Min sent to Airfinance Journal in May 2017. In both cases, the structure was illustrated as part of Haoyoubang and CN Aviation Loans’ marketing materials, with no mention of CALS, although in the May 2017 presentation it was included in the same PDF document as marketing materials for China International Aviation Leasing Service and CALS Financial Leasing (Shanghai).

Above: CN Aviation Loan's PDP financing model for airlines as client

“Normally, the total PDP may sum up to about 40% of the total purchase price of an aircraft, which is an important cash outflow for airlines and leasing companies,” the May 2017 Haoyoubang/CN Aviation Loan presentation says in introducing CN Aviation Loan’s “combination of internet finance and PDP financing”.

“Based on our clients’ requirement and our evaluation, we can provide customised PDP financing solutions with a maximum of 20% of the total airplane purchase price, which is equivalent to one half of the PDP financing needs.”

Haoyoubang and CN Aviation Loan’s clients must have aircraft purchase orders with an OEM in order to qualify for the financing, which can be between one and three years in tenor.

Above: CN Aviation Loan's PDP financing model for leasing firms as client

P2P fundraising for aircraft of the kind Haoyoubang and CN Aviation Loan proposed has a certain novelty factor, says King & Wood Mallesons Hong Kong’s head of aviation Tejaswi Nimmagadda. But, novelty aside, this kind of fundraising presents a high level of risk, Nimmagadda says.

“You can call it something else, but it doesn’t change the fact that it’s money raising for a collective investment and ought to be examined in that way. You can take money from the people simply based on the novelty factor, but if that money is lost or even perceived to be improperly used, then you have a whole bunch of unhappy people,” says Nimmagadda.

Airfinance Journal has found two instances when CALS falsely claimed it had completed transactions for fixed-wing aircraft.

CNCALS.com, which was taken offline after Airfinance Journal made inquiries about the website, published a now-deleted press release in January 2018 saying the company had leased an Airbus A330-300 purchased through crowdfunding to Finnair.

Huijbers says that press release is incorrect. Finnair also confirms it does not have any aircraft from CALS.

“The CNCALS.com website is the original website of CALS SHA [CALS Financial Leasing (Shanghai)] and covers all their business activities like medical, retail etc. Until Q1-2017 it also covered aviation, but then we established calsaviation.com for the aviation-related activities only – and only there, on calsaviation.com are any (by me) approved messages to the media with regards to aviation,” he says.

On 15 June 2018 Xing (Chris) Min, a member of CALS Aviation Group's capital markets team and Jiedong Min's daughter, posted text and images on her WeChat Moments claiming Haoyoubang had delivered a 737-900ER bearing MSN 37287 to Lion Air under Haoyoubang's Crowdfunding Aircraft Leasing Hong Yun Project (好友邦众筹飞租鸿运项目). One photo shows what appear to be five female Lion Air flight attendants holding up banners with the logos of CALS, Lion Air and Boeing. Two of the banners say "CALS 737-900ER 成功交付 [delivered to] Lion Air".

Beijing-based publication Business China also published an article on 16 July saying the transaction for the aircraft had been completed using a "business model of property co-ownership" (物权共有商业模式). Haoyoubang is listed as a "strategic partner" (战略合作伙伴) on Business China's website.

Valerie Tay, chief financial officer of Transportation Partners, the captive lessor of Lion Group, tells Airfinance Journal that Lion Air had "explored selling the aircraft to CALS and a pre-delivery inspection was arranged".

"But the issues at CALS erupted and the trade did not proceed," she says.

She says that before Airfinance Journal told her about the WeChat posts and Business China story, she had not been aware that "CALS had misrepresented that they are owning this aircraft".

A senior editor at Business China, who declines to be named, says the article is sponsored editorial (advertorial) written based on information provided by Haoyoubang, and he was not aware when it was published that the article might contain inaccurate information. He adds he is aware of Min's detention and that Haoyoubang has problems, but says he did not unpublish the article or the information about Haoyoubang being a strategic partner because he thought the information could be useful to the police in its investigation.

The editor also says his magazine published a sponsored interview with Min that was re-published in English on CALS Financial Leasing (Shanghai's) now defunct website CNCALS.com.

In addition, CALS also claimed in 2016 that it had completed a transaction for a rotary asset, but Huijbers says this is not the case.

CALS’ commercial director for Asia-Pacific and the Americas Minsi (Tina) Jiang said in a 15 July 2016 email – in which Min was copied – to Airfinance Journal that CALS had provided “PDP internet finance” for one G407 Bell helicopter. In that same email, CALS also said it was working on PDP internet finance for a Finnair A330.

Huijbers says CALS has “never been involved in rotary wing assets”.

An Asia-based source who has done external work for CALS says the result of Min’s detention will be that the market becomes “a bit wary of Chinese newcomers without a track record”.

But Johnny Lau, chief consultant in PricewaterhouseCoopers’ aviation business services department, who formerly acted as an advisor to CALS, says that despite Min’s detention, the market will “still see more newcomers” to the Chinese leasing market.

Peter Huijbers

Huijbers joined the company in January 2017, having previously worked as head of marketing at Hong Kong Aviation Capital (HKAC), which was merged into Avolon after the latter was acquired by HNA Group. He has over 30 years of aviation industry experience, and before HKAC had been employed in senior commercial positions at BMW Rolls-Royce, Lufthansa Technik and Nordcapital Aviation.

He is described by several market sources as the English-speaking, Western face of CALS.

Upon Huijbers’ appointment, Min said: “It is such an honour to have Peter being a leader and member of the CALS team, and also I feel assured that Peter has great faith in the model of our company, including our global innovative internet platform to support PDP, as well as the operating lease strategy.”

A source who has worked with CALS says the situation of Min’s detention is “a shame” for Huijbers.

“He’s a great guy with an excellent reputation in the market. He found a place where he could ply his trade. I’m absolutely convinced [the detention] has nothing to do with Peter. [Peter] just found someone who’s willing to back him [Peter],” the person says.

“He’s proved himself very, very capable of doing deals; he’s got lots of contacts. People are happy to do business with him and lease from him. CALS just was not the right shop to back.”

Huijbers says he is in no way involved with whatever Min has done to warrant a police investigation, nor is he involved in Min’s crowdfunding business.

One source, who declines to be named citing the sensitivity of the matter, says that the CEO of a company and the other board members have a responsibility to hold the company’s chairman to account.

The person notes that in mainland Chinese companies, the chairman tends to be “culturally more powerful”, despite having similar legal powers to a chairman in a Western country like the United States. A Chinese chairman typically is more likely to use his powers to remove executives he dislikes or disagrees with, and other executives and employees at a Chinese company are more likely to treat their chairman with a high-level of deference relative to a US company chairman.

He adds that if Min has not resigned as chairman, this could put CALS in limbo as the board may not be able to reach quorum to make decisions. Huijbers did not respond to a request for comment.

Companies named in the PSB report and CALS’ shareholding structure

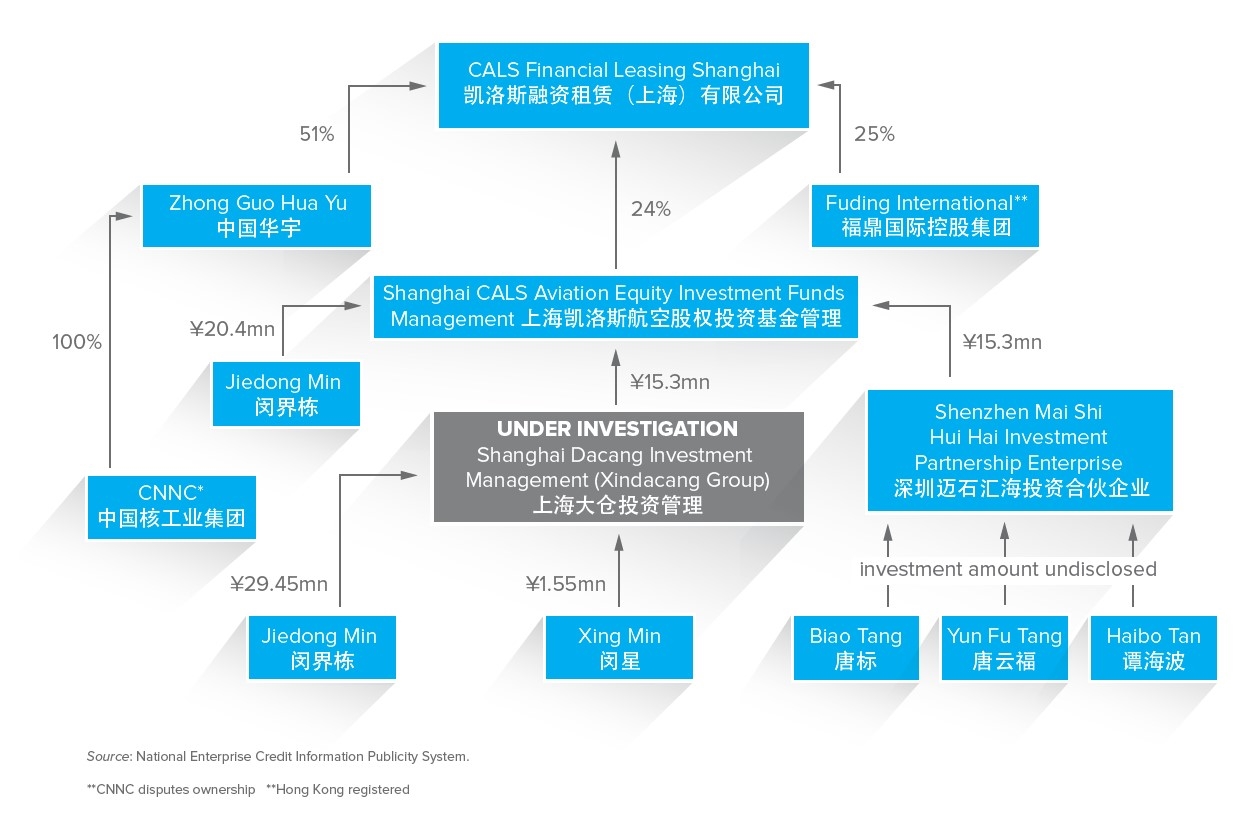

Min co-owns Xindacang with his daughter Xing Min: he has an RMB 29.45 million investment and she has an RMB 1.55 million investment, according to the National Enterprise Credit Information Publicity System (NECIPS).

Besides being chairman of CALS Financial Leasing (Shanghai), which was named in the Shanghai PSB statement, Min is also chairman of two other CALS-branded entities not named by the police: Ireland-registered China International Aviation Leasing Service and Shanghai CALS Aviation Equity Investment Fund Management.

Xindacang has a $15.3 million investment in Shanghai CALS Aviation Equity Investment Fund Management, which in turn owns 24% of CALS Financial Leasing (Shanghai). It was formerly known as Shanghai Dacang Investment Management and was established on 6 May 2010, before being renamed Xindacang on 30 January 2018. “Xin” means “new” in Mandarin.

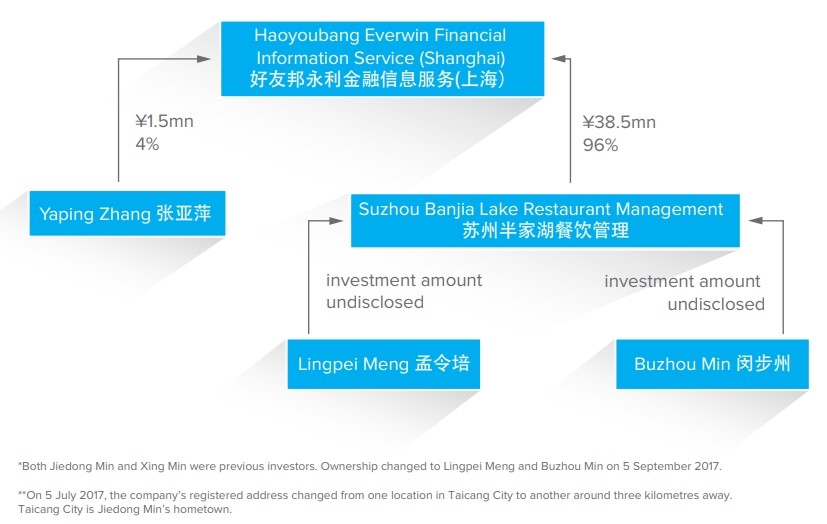

According to the NECIPS, Haoyoubang does not have a link to any CALS entities in its shareholding structure, though little public information is available about Haoyoubang’s owners: It is controlled by a company called Suzhou Banjia Lake Restaurant Management, which is in turn owned by two people called Lingpei Meng and Buzhou Min, about whom no further information is available. Buzhou Min’s surname uses the same Chinese character as Jiedong Min’s, but it is not clear whether the two are family. Before 5 September 2017, Jiedong Min and his daughter were investors, but after that date ownership changed to Lingpei Meng and Buzhou Min.

Above: Haoyoubang's shareholding structure. Source: NECIPS

In January 2016, Haoyoubang, CALS Financial Leasing (Shanghai) and Xindacang (under its former name) were sharing the same office floor. A photo posted on WeChat ‘Moments’ – a section of the hugely popular Chinese instant messaging app – of the company’s commercial director for Asia-Pacific and the Americas, Minsi (Tina) Jiang, shows five companies sharing the fifth floor of an office: China International Aviation Leasing Service; CALS Financial Leasing (Shanghai); Shanghai CALS Aviation Equity Investment Fund Management; Haoyoubang; and Shanghai Dacang Investment Management – the company that was later renamed Xindacang and is now under investigation.

Marketing materials sent to Airfinance Journal in May 2017 by Jiedong Min for Haoyoubang and CN Aviation Loan’s proposed internet P2P fundraising were in the same PDF document as marketing materials for CALS International Aviation Lease Service and CALS Financial Leasing (Shanghai).

P2P information provider Wangdaizhijia (网贷之家) says Haoyoubang and CN Aviation Loan’s office has been closed since 16 July. Photos on that site and different photos on blogging platform Baijiahao (百家号) show the office locked and empty.

A former Haoyoubang employee, speaking on condition of anonymity out of fear of incurring trouble with the police, confirms Haoyoubang has closed and all staff had to find new jobs. The person says he did not receive compensation and is owed salary by the company.

"We all feel angry, but we can't do anything," he says.

Huijbers says: “The company is awaiting shareholder guidance on its future positioning which is likely to follow once a statement on the investigation around Mr Min by the Shanghai police is made. The company does not share information about internal affairs nor speculates.

“It is correct that the situation of Mr. Min is related to his crowdfunding platform Haoyoubang and has nothing to do with either the CALS Aviation Group or me personally."

He has had no communication with the mainland Chinese or Hong Kong authorities regarding Min, he says.

According to the NECIPC, CALS Financial Leasing (Shanghai’s) ultimate owners are China National Nuclear (CNNC) and five individuals including Jiedong Min and Xing Min; as well as three other people called Biao Tang, Yunfu Tang and Haibo Tan, about whom no other information is available.

Above: CALS Financial Leasing (Shanghai's) shareholding structure.

Zhong Guo Hua Yu Economic Development took a 51% stake in CALS on 12 June 2016 and CNNC owns 100% of Zhong Guo Hua Yu Economic Development, according to a CALS company presentation and the NECIPC.

Several CALS company presentations also mention CNNC as the shareholder and multiple sources say CALS was keen to emphasise its links to the Chinese state-owned enterprise in meetings.

However, in a 6 February statement on its website, CNNC says Zhong Guo Hua Yu Economic Development (Hua Yu) is not a company funded or established by CNNC and any company or organisation established by Hua Yu that operates using the name of CNNC, or claims to be a CNNC affiliate, has never been approved by CNNC.

“Any activity conducted by Hua Yu and its subsidiaries does not represent CNNC or its affiliates; neither CNNC nor its affiliates will bear any legal consequences caused by any action of Hua Yu and/or its subsidiaries,” CNNC says.

CNNC declined to comment further when contacted by Airfinance Journal.

CNNC is directly controlled by the central government of the People’s Republic of China (PRC) and is “a leading element of national strategic nuclear forces and nuclear energy development”, according to its website.

The NEICPS lists CNNC’s business scope as including the production and sale of military nuclear products, without going into detail about what those products are. Airfinance Journal understands that at least one bank communicated to Huijbers its discomfort about CNNC as a shareholder.

“Any manufacturers of military equipment – regardless of its being nuclear – is of concern to banks. The fact that it is of a nuclear nature sets off double alarm bells,” says a source at that bank.

Airfinance Journal understands that after the bank raised concerns with CALS about CNNC as a shareholder, Huijbers emailed the bank attaching a letter from Jiedong Min that said CNNC is not involved in military business that is for “harmful or lethal purposes”. The person describes the letter as “poorly written”, as though it was written in Chinese and then auto-translated.

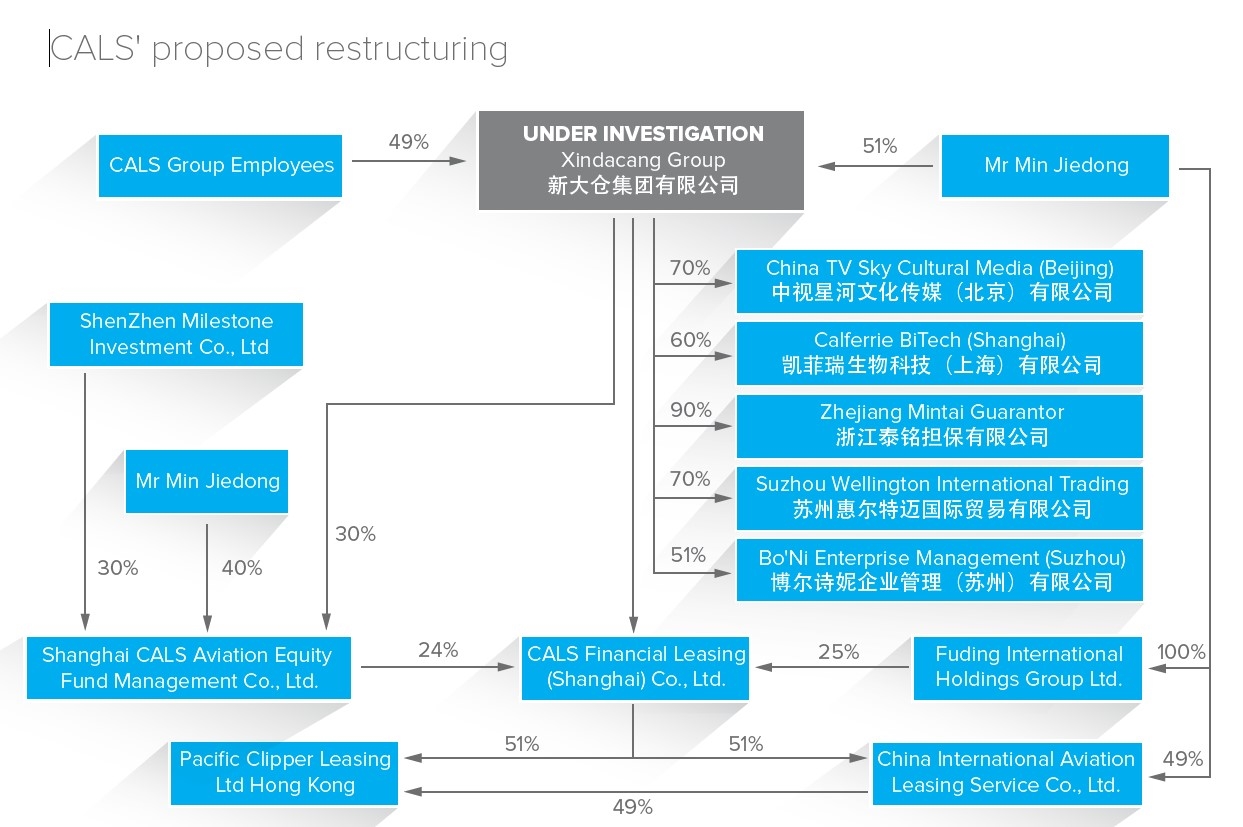

According to sources, in early 2018 CALS Aviation Group proposed a shareholding structure without CNNC or Zhong Guo Hua Yu Economic Development. In this structure, Xindacang – the company owned by Jiedong Min and now under investigation by the Shanghai PSB – would be the direct majority shareholder (51%) of CALS Financial Leasing (Shanghai). CALS Group employees would hold 49% of Xindacang and Min would retain a controlling 51% stake. CALS Financial Leasing (Shanghai) would then hold 51% of CALS International Aviation Lease Service and 51% of Pacific Clipper Leasing – Ireland-registered and Hong Kong-registered companies, respectively.

Above: CALS's proposed restructuring. Source: Airfinance Journal sources

It is not known how advanced this plan was, but it shows there was at least some chance that not only CALS Financial Leasing (Shanghai) but also two non-mainland Chinese companies could have come under the control of a company now under investigation by the Shanghai PSB.

On 26 February 2018, Xindacang widened its business scope to include aircraft sales and accessories, according to the NECIPS.

Min could not be reached for comment. Xing Min, who also worked for CALS as a member of the capital markets team, did not respond to WeChat messages seeking comment. She was an active user of WeChat ‘Moments’, posting updates almost every day, but since 15 July, the day before her father’s detention, her account has been silent. The former Haoyoubang employee tells Airfinance Journal that a rumour is circulating among his co-workers that Xing Min was also detained.

“From the precedent I know, if the shareholder or chairman was detained by police, then the police will officially investigate into details of the business and all the data in connection with the platform,” says Tao Yang, a partner at AllBright Law Offices in Beijing, who acts for a major Chinese P2P company.

“The chairman, legal representatives of the company, or shareholders usually will be detained by police and it will take time for the police to learn the details. If they can find some evidence that these people are violating the laws, then it will be a case which will subsequently go to the trial phase for the court to judge.”

He adds that this may take some time as “the police are very busy now because many P2P platforms have problems”.

For example, just days before Min’s detention, the Shanghai police detained Tao Lei, the legal representative of P2P platform Tangxiaoseng, for issuing illegal wealth-management products and offering return rates ranging from 5 to 15% a year, according to the South China Morning Post. The scheme involved a total of RMB 38 billion (around $5.5 billion). Airfinance Journal could not reach Tao Lei or Tangxiaoseng for comment.

“Actually, this is very common nowadays in China,” says Yang.

“The management and shareholders run away without reporting to the government. Many, many investors lose the money. It’s very serious in China now and that’s why the Chinese government is doing their best efforts to give a lot of regulations…they just want to stabilise this market.”

So many investors have been impacted that in July local officials in Hangzhou converted two sports stadiums into makeshift welcome centres where various district-level petition bureaus – the traditional channels for Chinese citizens to file miscellaneous grievances – could receive complaints from P2P investors, according to the Financial Times.

On 6 August 2018, Beijing police locked down the capital’s financial district to thwart protests by groups of investors who had lost money in the recent collapse of Chinese P2P platforms. Cases of Chinese citizens losing large sums of money have been widely reported.

On 12 August 2018, state-owned Xinhua News Agency reported that Chinese authorities are rolling out 10 measures to curb rising risks caused by the P2P lending sector.

The new measures proposed include asking local governments to set up “communications windows” to respond to requests by P2P investors and conducting compliance inspections on P2P companies. Local authorities are “strictly banned” from allowing the set-up of any new P2P companies or online finance platforms.

Previously, in August 2016, the China Banking Regulatory Commission (CBRC) imposed 13 restrictions on P2P platforms, prohibiting them from accepting public deposits, pooling investors' money for their own projects, providing guarantees for lenders, or selling financial products, according to Xinhua News Agency.

“P2P is obviously one of the areas the regulators are cracking down and that’s caused quite a significant impact in terms of that particular area. The P2P in particular has been exactly the target for the banking regulators,” says HFW’s Sun.

A prolific networker

Airfinance Journal was able to glean some details about Min’s activities in the run-up to his detention from the CNCALS.com website before it was taken down.

A prolific networker, Min seemed to have been courting airlines, financing companies, law firms and government officials to promote his business. However, the veracity of press releases on CNCALS.com should be questioned – at least two releases (one about his fake degree and one about the Finnair PDP-P2P transaction) contain false or misleading information – but Airfinance Journal has been able to independently confirm that at least two of the meetings (with Indian low-cost carrier Indigo and Japan’s Ministry of Finance) described in those releases indeed took place. There is no suggestion, however, that either of these two meetings are connected to his detention.

On 30 May, Min visited Indigo in Delhi, meeting with four executives responsible for aircraft finance and procurement. The press release says Min expressed hopes that his company could maintain a close partnership with Indigo to help with its 2018-2019 aircraft delivery plan.

Indigo declines to comment.

On 2 October 2017, Min visited Japan’s Ministry of Finance with Tomoo Nakayama, the chairman and director of ITC Aeroleasing.

Speaking to Airfinance Journal, Nakayama confirms he introduced Min to the Japanese Ministry of Finance after meeting Min at the May 2017 ISTAT Asia conference in Hong Kong. Min wanted to make an application to officially register Haoyoubang’s fintech business in Japan, Nakayama says.

Nakayama, who also introduced CALS to Tokyo-based lessors such as BOT Lease, says Japan’s Ministry of Finance was “fully prepared” to receive the application, but contact with Min and CALS tapered off and Nakayama later learnt from the news that Min had been detained in Shanghai.

“It’s a very unique idea, but in Japan the fintech business is very strictly controlled,” Nakayama says. “What they allow in China would not be allowed in Japan.”

A source who was introduced to the Haoyoubang aircraft crowdfunding model says: “Even to a sophisticated investor like a hedge fund or pension fund you still have to effectively and adequately explain the deal without hiding any short-fallings. If there is a risk of not getting your money back, you should alert them to any risk. When those sophisticated investors become unsophisticated investors like any Joe Bloggs on the street, the requirements ratchet up.”

Research and additional reporting by Elsie Guan.

Glossary of Chinese terms

Business China (中国商界)

China International Aviation Leasing Service (中国国际航空租赁服务)

China National Nuclear Corporation (中国核工业集团公司)

China International Aviation Leasing Service (中国国际航空租赁服务)

Haoyoubang Everwin Financial Information Service (Shanghai) (好友邦永利金融信息服务(上海)有限公司)

Higher People’s Court of Guangdong Province (广东省高级人民法院)

National Enterprise Credit Information Publicity System (NECIPS) (全国企业信用信息公示系统)

Shanghai CALS Aviation Equity Investment Fund Management (上海凯洛斯航空股权投资基金管理)

Shanghai Dacang Investment Management (上海大仓投资管理)

Shanghai Haoyin International Trade (上海昊银国际贸易有限公司)

Suzhou Banjia Lake Restaurant Management (苏州半家湖餐饮管理)

Zhong Guo Hua Yu Economic Development (中国华宇经济发展)